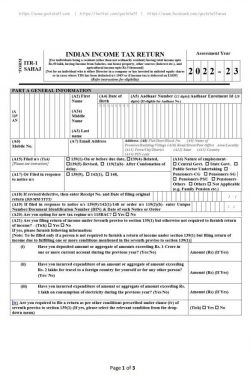

ITR-1 Sahaj: For individuals being a resident (other than not ordinarily resident) having total income upto Rs.50 lakh, having Income from Salaries, one house property, other sources (Interest etc.), and agricultural income upto Rs. CBDT notifies New ITR Forms for AY 2023-24 Also CBDT has released different sets of ‘Validation Rules’ for e-filing of ITR Forms in respect of AY 2022-23. Subsequently, the functionality/ utility for E-filing of ITR-1 Sahaj, ITR-2, ITR-4 Sugam and ITR-5 for AY 2022-23 has been enabled (offline & online both), as per E-filing Portal update dt. CBDT has notified the new ITR Forms applicable for AY 2022-23 (Forms ITR-1 Sahaj, ITR-2, ITR-3, ITR-4 Sugam, ITR-5, ITR-6 and ITR-7), without making any significant changes therein as compared to last year.

0 kommentar(er)

0 kommentar(er)